Embracing Bitcoin’s Volatility

A friend suggested hitting volatility head on when introducing Bitcoin to a new audience so let’s briefly touch on that.

Bitcoin is volatile, so the real question is how compelling is holding Bitcoin over the long term in spite of the volatility.

Long story short, very. So let’s unpack that.

Zoom out

First things first, at a casual glance at the price chart a couple of big humps and declines jump out at you.

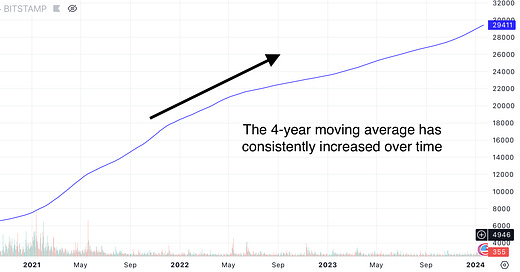

But when you zoom out and look at a logarithmic chart, you see a clear pattern of higher highs and higher lows over a sequence of 4-year periods.

As a result, the 4-year moving average steadily increases over time.

Price in the very short term is anyone’s guess, but as you approach a 4-year period, Bitcoin becomes a less speculative, more reliable long-term store of value especially if you Dollar Cost Average (DCA).

You can also see that Bitcoin’s volatility is decreasing over time as it matures.

Risk Adjusted Return

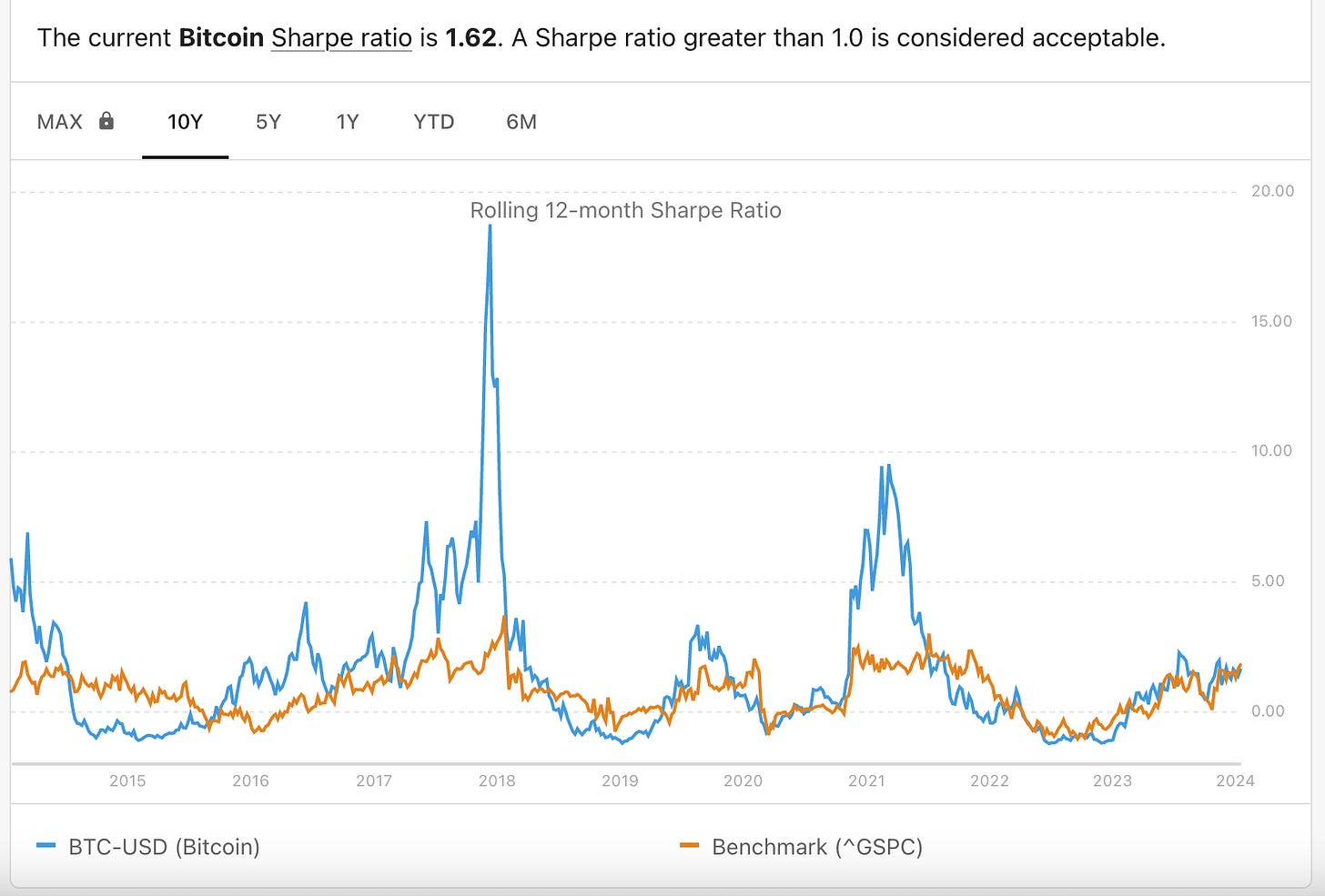

The Sharpe Ratio measures the risk adjusted return for an investment. In the chart by Portfolios Lab below you compare Bitcoin’s 12-month rolling Sharpe Ratio with the S&P500 benchmark over the past decade. You’ll notice it generally trends well with outsized performance by Bitcoin during its major run-ups in price each cycle.

A couple of months ago, Jurrien Timmer, the Director of Global Macro at Fidelity did an analysis on the risk-reward for different asset classes including Bitcoin. He showed draw-downs from the 2-year high on the left, and gains from the 2-year low on the right as of November, 2023, with weekly data, ranked from smallest to largest draw-down.

Bitcoin was in a completely different league.

Overall impact on a portfolio

The folks at Swan put together the Nakamoto Portfolio, a helpful tool for evaluating the impact of Bitcoin on an overall portfolio. You can see how Bitcoin would have impacted historical performance on various portfolio mixes of stocks, bonds and other assets.

For instance adding 5% and 10% Bitcoin allocation to the standard 60/40 stock/bond portfolio would have increased the annualized return from ~8% to ~13% and ~18% respectively over the past 9 years.

Dialing things back a bit from Sharpe Ratios and portfolio analysis, if you view Bitcoin simply as long-term savings, do you want to hold something that is volatile, but with increasing demand and a fixed supply that can’t be debased. And with the reasonable expectation of less volatility over time as the market cap of Bitcoin increases.

Or something that is not volatile, but steadily loses value?